The Web Scraping Market Report 2025–2030 (Preview)

Cloud-first deployments account for 68% of the market and BFSI sector adoption is increasing, representing 30% of total market share. The global web scraping will see CAGR of ~11.9% through 2032.

The Rising Value of Data Extraction

The global web scraping software market was valued at approximately $1.01 billion in 2024 and is projected to grow at a CAGR of ~11.9% through 2032 (BrowserCat, Mordor Intelligence).

With real-time data fueling AI, competitive intelligence, and price monitoring, web scraping has become a strategic necessity across industries from e-commerce to finance. Companies that leverage efficient scraping solutions can outperform competitors in speed, insight, and operational efficiency.

Key questions the full report answers:

Which deployment models are gaining dominance in 2024?

Which sectors are driving adoption and how?

How do leading vendors compare in market share, capabilities, and pricing?

Executive Summary (Partial)

Global Market Size (2024): $1.01 billion

Projected CAGR (2025–2032): 11.9%

Major Trends:

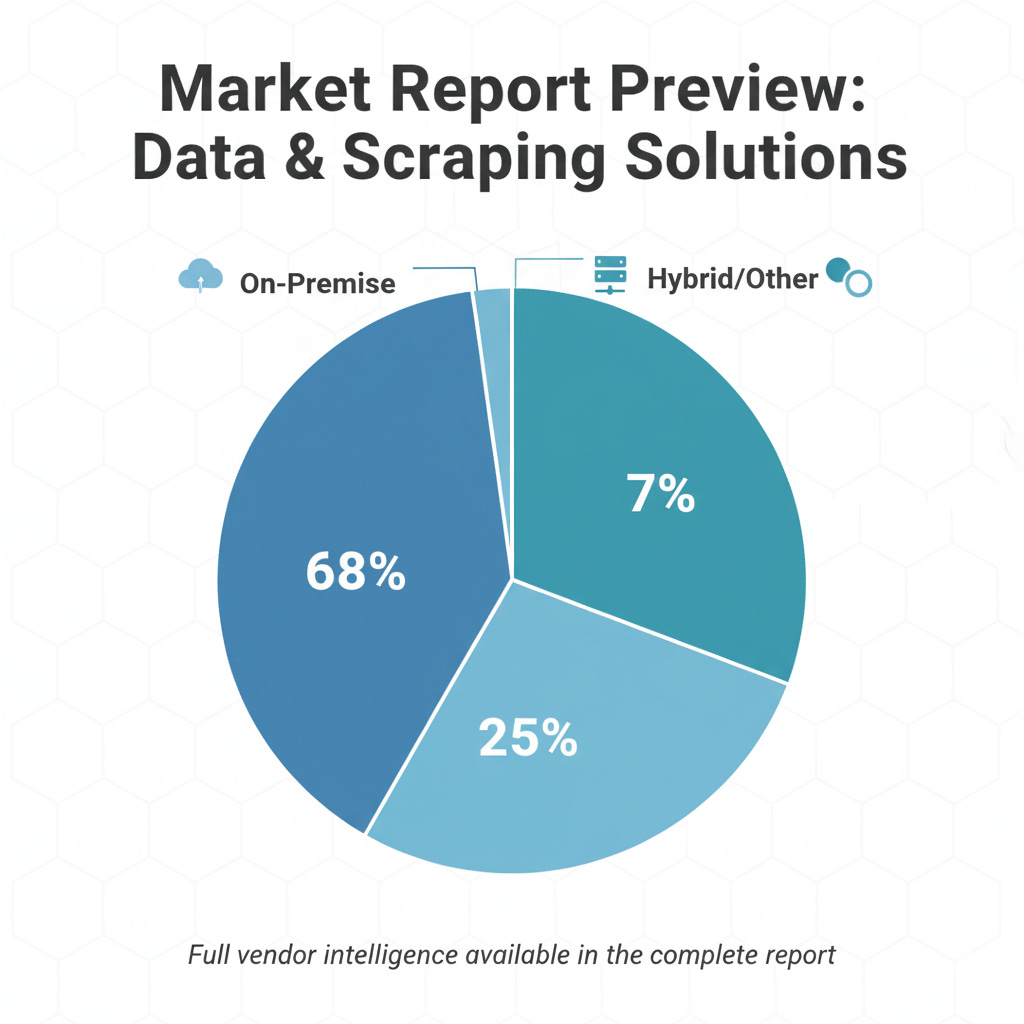

Cloud-first deployments account for 68% of the market (Mordor Intelligence)

BFSI sector adoption is increasing, representing 30% of total market share

Price and competitive monitoring continues to be a major driver with high growth potential

Controversial Insight: Despite major vendor dominance, the market remains highly fragmented, leaving opportunities for niche providers and open-source frameworks.

Table of Contents (Teaser)

Market Overview — Introduction, definitions, and scope

Market Size & Forecast — Historical and projected global growth

Deployment Trends — Cloud vs. on-premise adoption

Industry Adoption — Sector-wise analysis including BFSI, e-commerce, real estate

Competitive Landscape — Major vendors, market share, and emerging disruptors

Regional Analysis — North America, Europe, APAC dynamics

Technological Advancements — AI/ML integration, headless browsers, cloud-native tools

Regulatory Landscape — GDPR, CCPA, hiQ vs. LinkedIn and other cases

Market Challenges — Technical, legal, and operational obstacles

Strategic Recommendations — Guidance for executives, product managers, and investors

Insights — What You’ll Discover

Market Leaders: Bright Data, Apify, and Octoparse dominate enterprise adoption; open-source frameworks like Scrapy remain heavily used by developers.

Emerging Trends: AI-based scraping agents are increasing efficiency, enabling automated detection of site changes and real-time extraction.

Regulatory Developments: The hiQ Labs vs. LinkedIn case continues to influence compliance and risk mitigation strategies.

Partial Vendor Comparison (Teaser):

5. Sample Table — Market Segmentation by Deployment (2024)

6. Methodology & Sources

Sources: Mordor Intelligence, BrowserCat, Market Research Future, Verified Market Research, Straits Research among others.

Methodology: Combines primary interviews, vendor reports, and secondary research to ensure accuracy and actionable insights.

7. Strategic Value

This report is designed for:

Executives evaluating build/buy strategies

Product Managers comparing vendor solutions

Investors analyzing market opportunities

Data Teams planning infrastructure and automation pipelines

Consultants advising clients on strategic initiatives

It provides actionable insights to navigate the rapidly evolving web scraping market.

The full report includes:

Complete vendor comparison (25+ companies)

Regional market breakdowns (NA, EU, APAC)

Pricing & ROI frameworks

Detailed legal and regulatory analysis

AI and emerging technology trends

Strategic recommendations and scenario planning